UAE iGaming ROI Insights

ROI Reimagined for the UAE iGaming Market

ROI Reimagined for the UAE iGaming Market

Data-backed ROI insights based on real UAE CPM, ARPU, and retention benchmarks.

UAE CPM is 3× higher than APAC, yet ARPU is 2× higher.

Understanding this unique growth math is the key to scaling profitably.

Key UAE Market Cost &Value Benchmarks

Key UAE Market Cost

Value Benchmarks

Key UAE Market Cost & Value Benchmarks

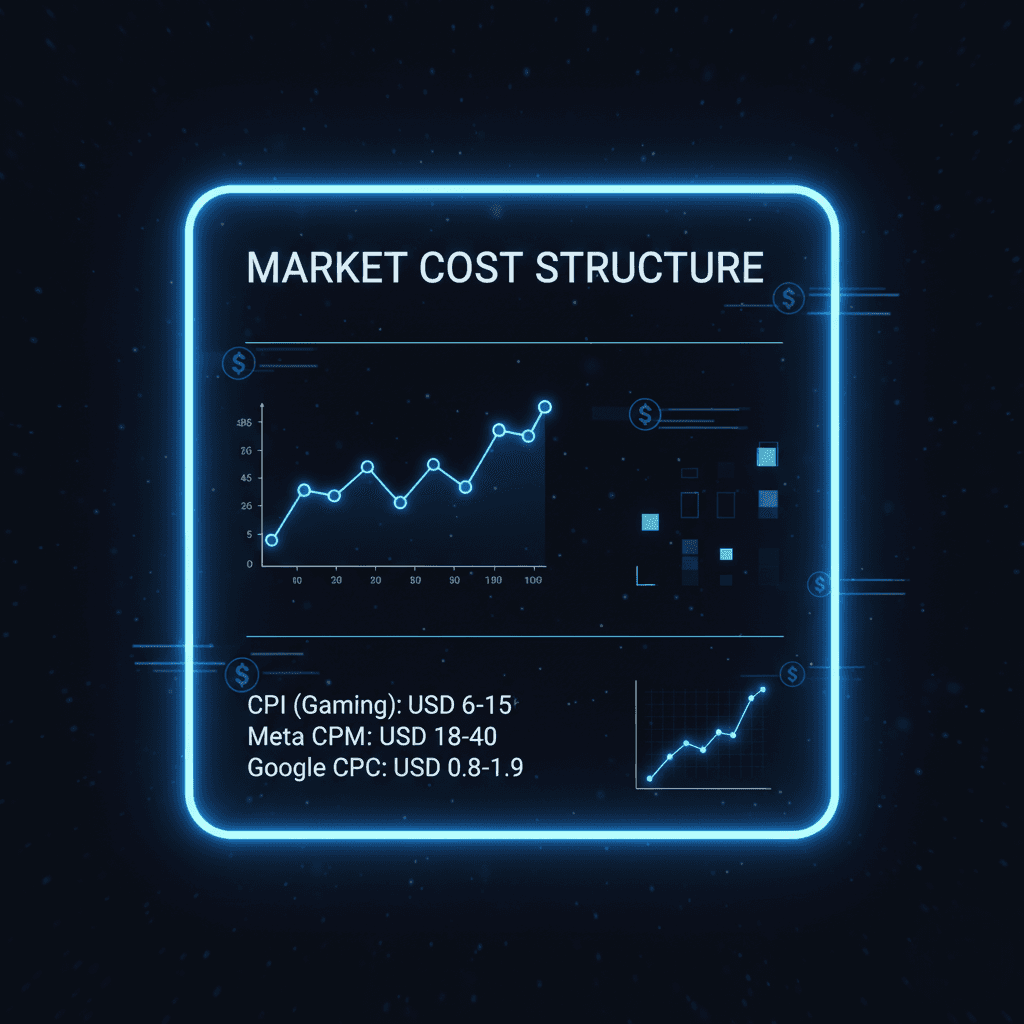

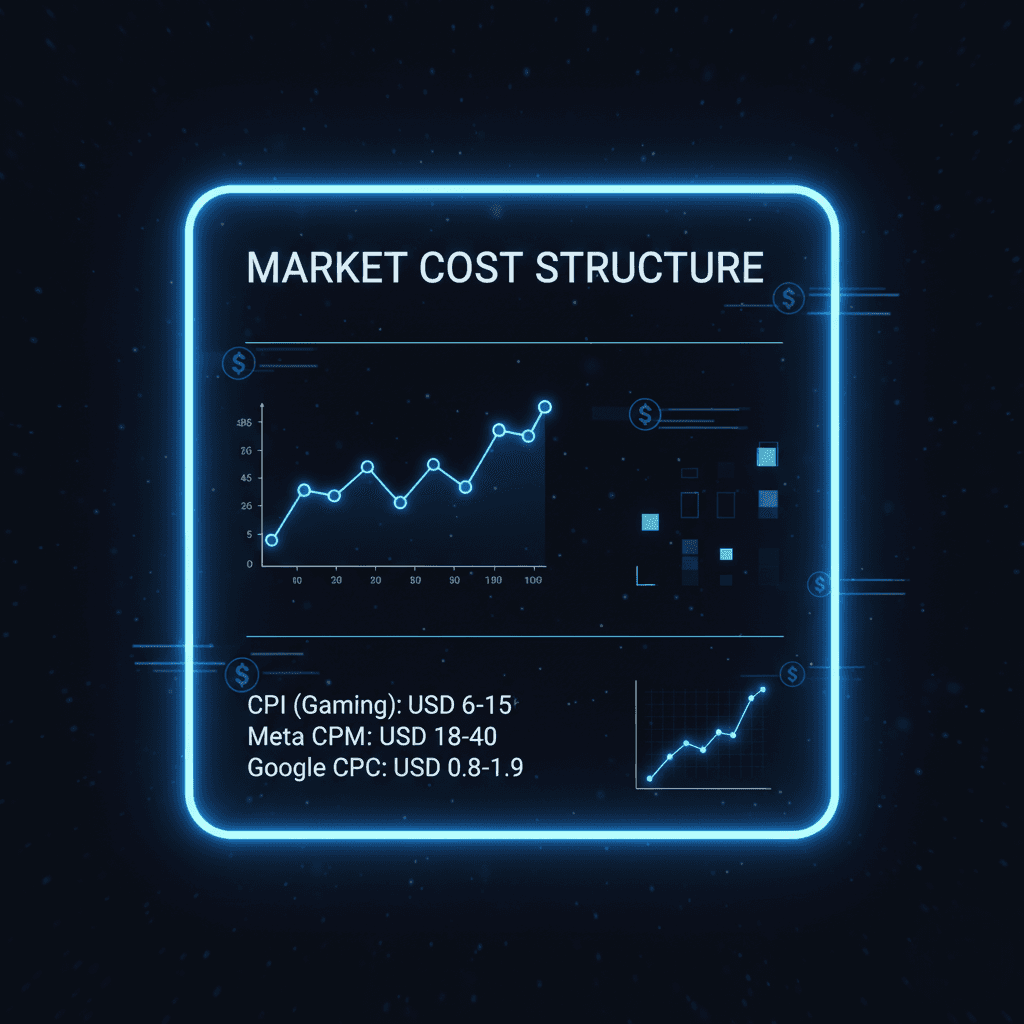

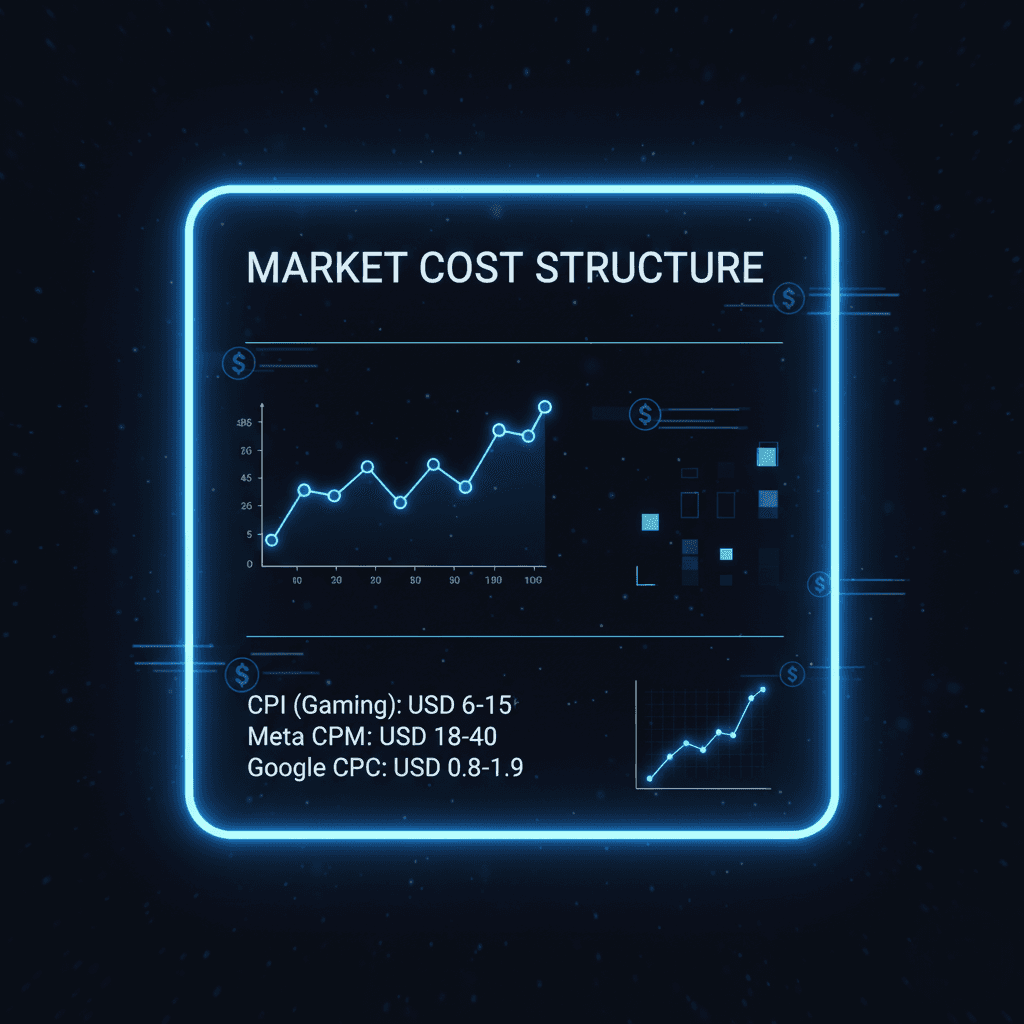

Market Cost Structure

Market Cost Structure

• Meta MENA CPM: USD 18–40

• Google Ads CPC: USD 0.8–1.9

• CPI (Gaming): USD 6–15

Source: Meta Ads Benchmark, AppsFlyer MENA

• Meta MENA CPM: USD 18–40

• Google Ads CPC: USD 0.8–1.9

• CPI (Gaming): USD 6–15

Source: Meta Ads Benchmark, AppsFlyer MENA

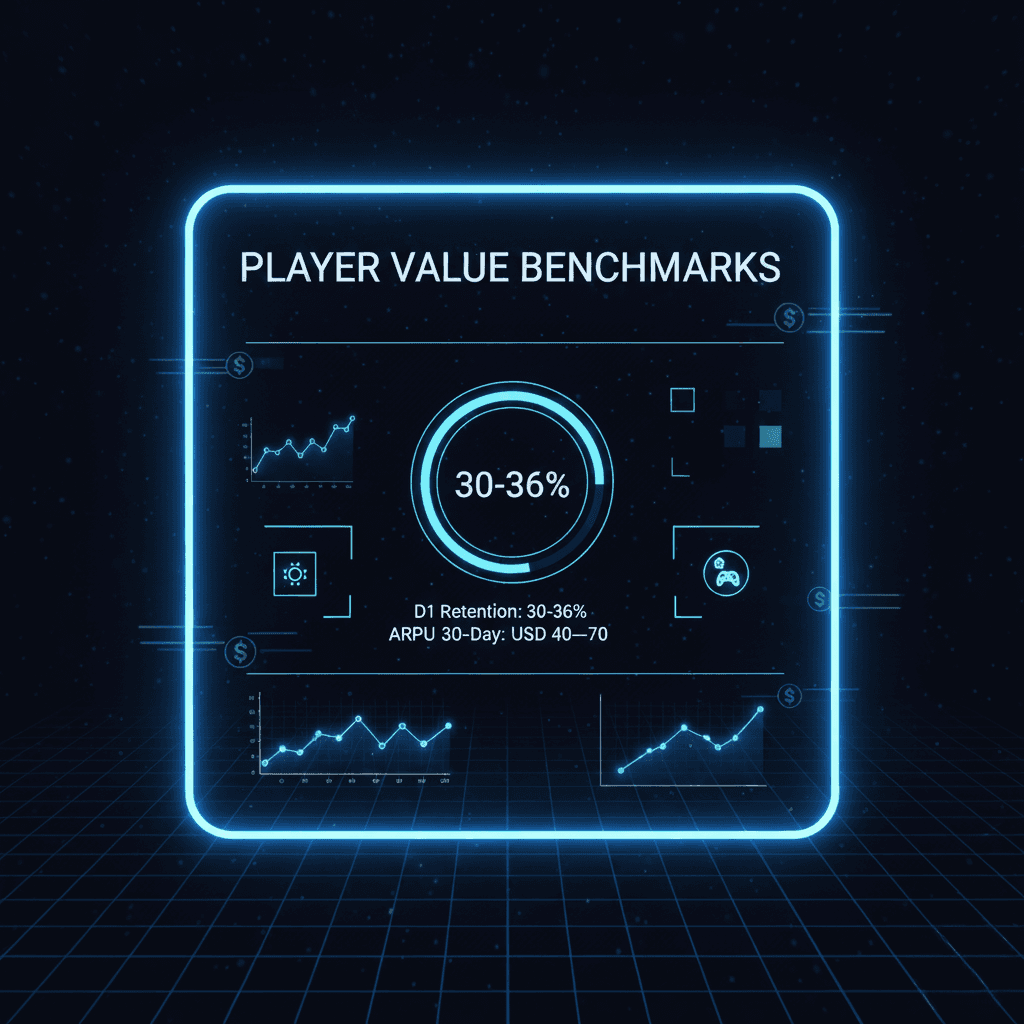

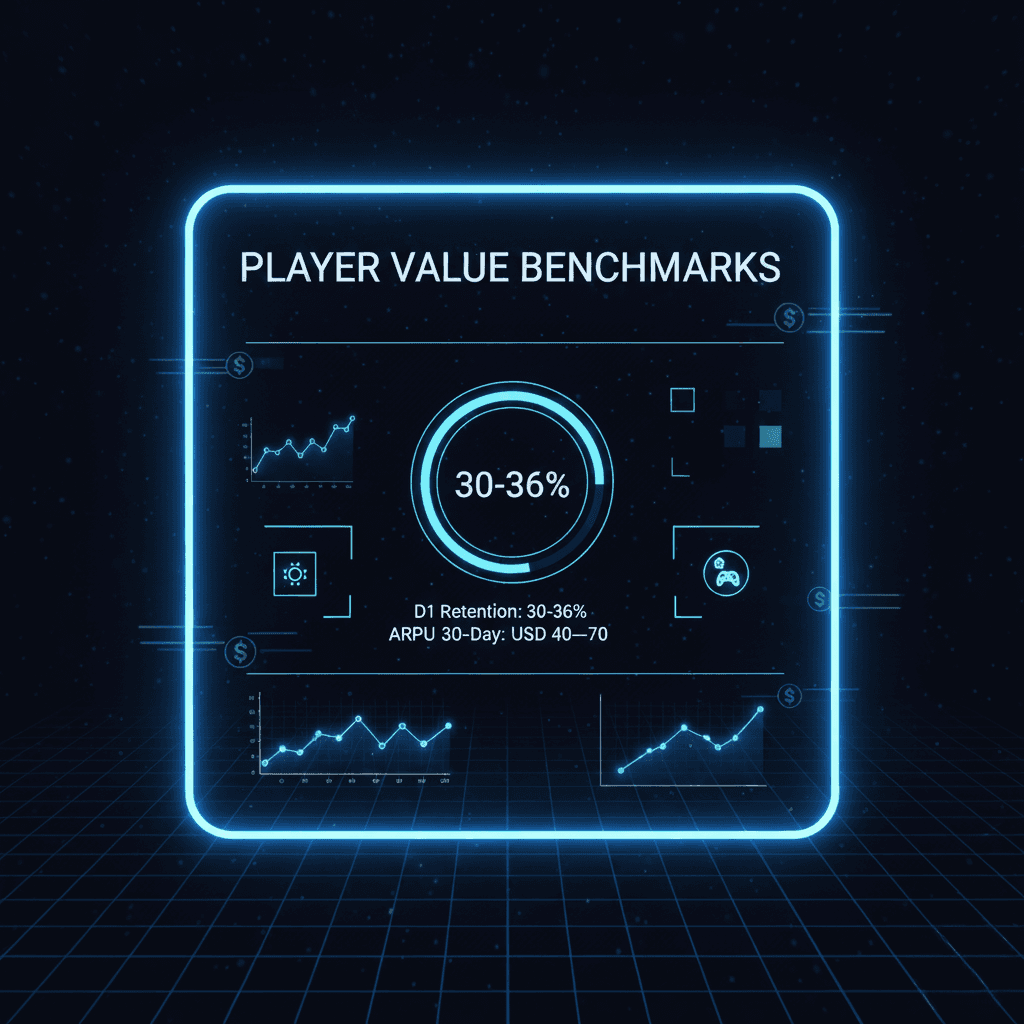

Player Value Benchmarks

Player Value Benchmarks

• ARPU 30-day: USD 40–70

• D1 retention: 30–36%

• D30 retention: 4–6%

Source: data.ai, GameAnalytics, AppsFlyer

Payment Funnel

Payment Funnel

• Payment success rate: 88–94%

Source: Checkout.com MENA Report

• Payment success rate: 88–94%

Source: Checkout.com MENA Report

Why UAE ROI Needs a Different Growth Model

Why UAE ROI Needs a Different Growth Model

Most markets optimize ROI through traffic volume — buy more ads, push more bonuses, repeat.

But UAE does not follow this model.

UAE ROI grows through behavioral conversion and payment reliability, not traffic scaling.

If operators do not adapt their ROI model, ROI rarely breaks past the 80–100% ceiling.

This is why UAE requires a new ROI formula.

UAE ROI Proof Points Backed by Real Operator Data

UAE ROI Proof Points Backed by Real Operator Data

These metrics reflect publicly available benchmarks from AppsFlyer, Checkout.com, and GameAnalytics.

ROI Breaks 100% with the Right Model

ROI Benchmark (90 days)

Payment Success Drives ROI

+8–15% ROI uplift

Lower Decline, Higher ARPU

+12–22% ARPU impact

Retention Quality Matters

+6–11% retention lift

What Top-Performing UAE Campaigns Look Like

What Top-Performing UAE Campaigns Look Like

• 90-day ROI for top operators: 110–135%

• Payment optimization improves ROI by +8–15%

• Reducing payment decline rate can boost ARPU by +12–22%

Based on public benchmarks from AppsFlyer, Checkout.com and GameAnalytics.

FAQ

FAQ

Q1. How is ROI calculated in the UAE iGaming market?

ROI = (Revenue – Marketing Cost) / Marketing Cost. UAE ROI behaves differently because traffic is expensive, but ARPU is much higher than APAC, making conversion and payment reliability more important than traffic volume.

Q1. How is ROI calculated in the UAE iGaming market?

ROI = (Revenue – Marketing Cost) / Marketing Cost. UAE ROI behaves differently because traffic is expensive, but ARPU is much higher than APAC, making conversion and payment reliability more important than traffic volume.

Q1. How is ROI calculated in the UAE iGaming market?

ROI = (Revenue – Marketing Cost) / Marketing Cost. UAE ROI behaves differently because traffic is expensive, but ARPU is much higher than APAC, making conversion and payment reliability more important than traffic volume.

Q2. Why can’t UAE iGaming ROI use APAC or EU optimization formulas?

Because UAE CPM is 3× higher while ARPU is 2× higher. This market depends on behavioral conversion and payment success rate—not on traffic scaling.

Q2. Why can’t UAE iGaming ROI use APAC or EU optimization formulas?

Because UAE CPM is 3× higher while ARPU is 2× higher. This market depends on behavioral conversion and payment success rate—not on traffic scaling.

Q2. Why can’t UAE iGaming ROI use APAC or EU optimization formulas?

Because UAE CPM is 3× higher while ARPU is 2× higher. This market depends on behavioral conversion and payment success rate—not on traffic scaling.

Q3. What benchmarks define healthy ROI in the UAE market?

Healthy ROI in the UAE is typically defined by 90-day performance benchmarks, not short-term payback. Based on public data, most operators aim for 80–100% ROI as a baseline, while top-performing operators can reach 110–135% ROI within 90 days. These higher benchmarks are usually achieved through strong payment success rates, behavioral conversion, and retention optimization, rather than traffic scaling.

Q3. What benchmarks define healthy ROI in the UAE market?

Healthy ROI in the UAE is typically defined by 90-day performance benchmarks, not short-term payback. Based on public data, most operators aim for 80–100% ROI as a baseline, while top-performing operators can reach 110–135% ROI within 90 days. These higher benchmarks are usually achieved through strong payment success rates, behavioral conversion, and retention optimization, rather than traffic scaling.

Q3. What benchmarks define healthy ROI in the UAE market?

Healthy ROI in the UAE is typically defined by 90-day performance benchmarks, not short-term payback. Based on public data, most operators aim for 80–100% ROI as a baseline, while top-performing operators can reach 110–135% ROI within 90 days. These higher benchmarks are usually achieved through strong payment success rates, behavioral conversion, and retention optimization, rather than traffic scaling.

Q4. What limits ROI growth most in the UAE?

Payment decline rate. Each 1% improvement in approval rate increases ARPU and ROI significantly (+8–22%).

Q4. What limits ROI growth most in the UAE?

Payment decline rate. Each 1% improvement in approval rate increases ARPU and ROI significantly (+8–22%).

Q4. What limits ROI growth most in the UAE?

Payment decline rate. Each 1% improvement in approval rate increases ARPU and ROI significantly (+8–22%).

Q5. Why doesn’t traffic scale ROI in the UAE?

The biggest constraint on ROI growth in the UAE is payment reliability and behavioral conversion friction, not traffic volume. Many operators can acquire users, but ROI stalls when payment success rates drop or when bonus mechanics fail to convert users into repeat payers. In the UAE, even small inefficiencies in payment flow or reward pacing can significantly cap ROI performance. This is why top-performing operators prioritize payment optimization and in-game behavioral design over aggressive traffic scaling.

Q5. Why doesn’t traffic scale ROI in the UAE?

The biggest constraint on ROI growth in the UAE is payment reliability and behavioral conversion friction, not traffic volume. Many operators can acquire users, but ROI stalls when payment success rates drop or when bonus mechanics fail to convert users into repeat payers. In the UAE, even small inefficiencies in payment flow or reward pacing can significantly cap ROI performance. This is why top-performing operators prioritize payment optimization and in-game behavioral design over aggressive traffic scaling.

Q5. Why doesn’t traffic scale ROI in the UAE?

The biggest constraint on ROI growth in the UAE is payment reliability and behavioral conversion friction, not traffic volume. Many operators can acquire users, but ROI stalls when payment success rates drop or when bonus mechanics fail to convert users into repeat payers. In the UAE, even small inefficiencies in payment flow or reward pacing can significantly cap ROI performance. This is why top-performing operators prioritize payment optimization and in-game behavioral design over aggressive traffic scaling.

Q6. Why does UAE ROI often plateau at 80–100%?

ROI in the UAE often plateaus at 80–100% when operators rely on traditional, traffic-driven growth models. Due to high CPM and CPI, additional acquisition spend does not translate into proportional revenue gains unless payment reliability, player behavior loops, and retention mechanics are optimized. Breaking this plateau requires a shift toward conversion-led ROI optimization, which is fundamentally different from APAC or EU strategies.

Q6. Why does UAE ROI often plateau at 80–100%?

ROI in the UAE often plateaus at 80–100% when operators rely on traditional, traffic-driven growth models. Due to high CPM and CPI, additional acquisition spend does not translate into proportional revenue gains unless payment reliability, player behavior loops, and retention mechanics are optimized. Breaking this plateau requires a shift toward conversion-led ROI optimization, which is fundamentally different from APAC or EU strategies.

Q6. Why does UAE ROI often plateau at 80–100%?

ROI in the UAE often plateaus at 80–100% when operators rely on traditional, traffic-driven growth models. Due to high CPM and CPI, additional acquisition spend does not translate into proportional revenue gains unless payment reliability, player behavior loops, and retention mechanics are optimized. Breaking this plateau requires a shift toward conversion-led ROI optimization, which is fundamentally different from APAC or EU strategies.

Q7. What is the realistic ROI ceiling for UAE operators?

Most operators stagnate at 80–100% unless they optimize: • Payment flows • Reward pacing • Retention loops Once optimized, the ceiling extends to 110–135%.

Q7. What is the realistic ROI ceiling for UAE operators?

Most operators stagnate at 80–100% unless they optimize: • Payment flows • Reward pacing • Retention loops Once optimized, the ceiling extends to 110–135%.

Q7. What is the realistic ROI ceiling for UAE operators?

Most operators stagnate at 80–100% unless they optimize: • Payment flows • Reward pacing • Retention loops Once optimized, the ceiling extends to 110–135%.

Based on public benchmarks from AppsFlyer, Checkout.com and GameAnalytics.

Ready to see how your ROI compares?

Compare Your ARPU With

UAE Market Benchmarks

Benchmark your ROI performance against the UAE market.

Benchmark your ROI performance against the UAE market.

Benchmark your ROI performance against the UAE market.